Insight Blog

Agility’s perspectives on transforming the employee's experience throughout remote transformation using connected enterprise tools.

24 minutes reading time

(4819 words)

How Financial Stress Impacts Employee Wellbeing — and How Employers Support Their Workforce

Financial stress is quietly damaging employee wellbeing at work. Learn how it impacts performance — and how employers can support their workforce effectively.

When organisations talk about workplace employee wellbeing, the focus usually lands on mental health initiatives, flexible working, or wellness perks.

All useful — but incomplete.

The biggest pressure most employees are dealing with isn't burnout apps or mindfulness.

It's money.

Financial stress impacts employees long before the workday starts. Rising living costs, debt, rent, childcare, and basic household expenses don't pause when someone logs into work.

Those worries follow people into meetings, deadlines, and performance conversations — whether employers acknowledge it or not.

By 2026, the data makes this impossible to ignore.

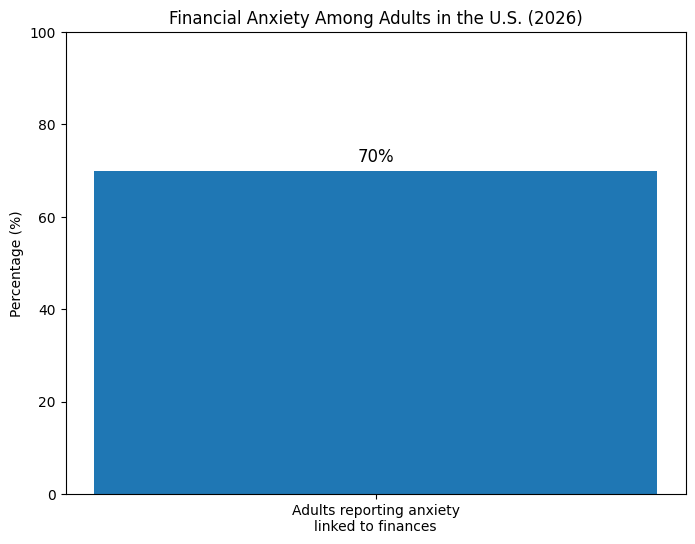

More than 70% of adults in the U.S. report anxiety linked to their financial situation, and many say it directly affects their ability to focus and perform at work.

This is no longer a private issue happening outside the office. It's showing up inside the workplace every single day.

That's why employee wellbeing has shifted from a "nice initiative" to a core business concern.

When financial stress goes unaddressed, productivity drops, engagement fades, retention weakens, and trust in leadership quietly erodes.

The reality is simple: you can invest heavily in wellbeing programmes, but if employees are worried about making ends meet, those efforts won't stick.

In this article, we'll explore how financial stress impacts employee wellbeing in the workplace, the warning signs employers often miss, and the practical ways organisations can support their workforce — without overstepping or pretending to be financial advisors.

Key Takeaways You’ll Get From This Guide

- Financial stress impacts employee wellbeing in the workplace through anxiety, poor sleep, reduced focus, and lower performance.

- It doesn’t just affect individuals — it quietly reshapes workplace culture by reducing collaboration, trust, and motivation over time.

- Employers don’t need to “fix” personal finances, but they can support employees with clear resources, transparent policies, and practical financial wellness benefits.

- Warning signs include drops in engagement, increased absenteeism, reduced team participation, and spikes in mistakes or slower decisions.

- Digital workplace hubs like AgilityPortal make support easier to access by centralising communication, wellbeing resources, and feedback tools in one place.

- A financially supportive culture is built through consistent actions — not one-off wellbeing campaigns.

Read this article: : Top 6 AI-Powered Project Management Tools To Use In 2023

What Is Financial Stress in the Workplace?

Before we go any further, it's worth getting clear on what financial stress in the workplace actually means — because it's often misunderstood or oversimplified.

At its core, financial stress is the ongoing pressure employees feel when their income doesn't comfortably cover their real-life costs.

We're talking about things like rising living expenses, rent or mortgage payments, debt, childcare, healthcare bills, and unexpected emergencies.

This is closely tied to what is financial wellbeing: the ability for someone to feel secure, in control, and confident about their current and future financial situation.

When financial wellbeing is low, stress creeps in — and it doesn't stay at home.

Why Financial Stress Shows Up at Work (Even If You Don't See It)

Many employers assume money worries are a "personal issue."

In reality, they show up every day in subtle ways:

- Difficulty concentrating during meetings

- Anxiety around performance and job security

- Avoidance of social or team activities

- Increased absenteeism or presenteeism

Employees rarely speak openly about money stress, which is why it often goes unnoticed. But silence doesn't mean it isn't there — it just means it's unmanaged.

This is exactly why more organisations are starting to use financial wellness surveys.

These surveys help employers understand how money-related stress is affecting focus, morale, and engagement across teams, without forcing individuals to overshare or feel exposed.

Financial Stress vs Short-Term Money Worries

It's also important to separate temporary money worries from chronic financial stress.

- A short-term issue might be a one-off unexpected expense.

- Financial stress in the workplace is ongoing and persistent — it lingers for months or years and slowly chips away at confidence, energy, and wellbeing.

When left unchecked, financial stress impacts employee wellbeing far beyond finances, affecting mental health, physical health, and overall job performance.

Why Employers Are Paying Attention Now

This growing awareness is why financial wellness employee benefits are becoming part of modern wellbeing strategies.

Not as handouts or salary fixes — but as structured support, education, clarity, and access to resources that help employees feel more in control.

Ignoring financial stress doesn't make it go away. It just makes it harder to manage — for employees and for the organisation.

Next, we'll look at how financial stress directly impacts employee wellbeing in the workplace — from mental health and productivity to engagement, retention, and workplace culture.

How Financial Stress Impacts Employee Wellbeing

Financial stress doesn't clock out at the end of the day.

It follows employees into the workplace and quietly affects how they think, feel, and perform.

When this pressure goes unaddressed, workplace employee wellbeing starts to break down across multiple areas — not all of them obvious at first.

Financial burden: Impacts of financial stress on employees' work

Percent of employees reporting each impact

Affects sleep so I'm tired at work

45%

Less able to focus and concentrate

38%

Less productive

25%

Less patient with colleagues/customers

19%

Mental & Emotional Wellbeing

This is usually where the impact shows up first.

Employees dealing with ongoing money worries often experience higher levels of anxiety and mental fatigue. Even when they're physically present, their attention is split between work tasks and personal financial concerns.

That constant background stress makes it harder to concentrate, process information, and make confident decisions.

Over time, this mental load can lead to burnout. Not because the workload is excessive — but because the employee never truly gets mental relief.

Financial stress impacts emotional resilience, leaving people more reactive, less patient, and more overwhelmed by everyday work challenges.

Physical Wellbeing

Mental stress eventually shows up in the body.

Poor sleep is one of the most common side effects of financial strain.

Employees may struggle to rest properly, which affects energy levels, mood, and overall health.

This often leads to increased sick days, frequent short absences, or employees pushing through work while unwell.

From an employer's perspective, this looks like rising absenteeism or inconsistent attendance. In reality, it's a sign that financial stress is eroding physical wellbeing behind the scenes.

Work Performance

When people are financially stressed, performance suffers — even among high performers.

Focus drops. Simple tasks take longer.

Mistakes happen more often.

Employees may appear slower, less sharp, or less engaged than usual. One of the most costly outcomes is presenteeism: employees show up to work but aren't fully functioning.

This is where financial stress impacts productivity most directly.

Work still gets done, but not at the level it should — and managers often misread this as a motivation or capability issue, rather than a wellbeing one.

Engagement & Workplace Culture

Over time, financial stress reshapes how employees connect with their workplace — and the data backs this up.

By 2026, research consistently shows that over 60% of employees experiencing financial stress report lower motivation at work, and nearly 1 in 3 say they deliberately avoid optional meetings, collaboration, or extra responsibilities because they're mentally exhausted. This isn't apathy — it's cognitive overload.

Trust is another silent casualty.

Studies indicate that employees under financial pressure are significantly less likely to trust leadership messaging around wellbeing, especially when those messages don't acknowledge real financial pressures like cost of living, debt, or job security.

When wellbeing initiatives feel disconnected from reality, employees disengage emotionally — even if they remain physically present.

As more employees operate in this state, culture shifts.

Teams become quieter, innovation slows, and collaboration turns transactional.

In fact, engagement data shows that financially stressed employees are up to 2× more likely to report feeling disengaged or disconnected from company culture compared to financially secure peers.

The takeaway is simple and unavoidable: financial stress doesn't stay at home. It shows up in meetings, decision-making, collaboration, and trust. And over time, it directly shapes workplace employee wellbeing, performance, and culture.

Next, we'll look at why employers can no longer afford to ignore financial stress — and how it directly impacts retention, productivity, and long-term business resilience.

Related Guides You May Want to Read Next

This article explores how financial stress impacts employee wellbeing. The guides below go deeper into financial wellbeing, productivity, and digital workplace strategy to help you build a more resilient workforce.

- Why Workplace Financial Wellbeing Is the Next Big Employee Benefit (And What You’ll Miss If You Ignore It)

- Why Wellbeing in the Workplace Is Being Ignored and Personal Injury Claims Are Paying the Price

- Remote Employee Productivity – The Complete Outside-the-Box Guide

- What Is an Intelligent Digital Workplace?

- Digital Workplace Business Case – UPDATED 2026 – A Complete Guide

Read this article: : Top 6 AI-Powered Project Management Tools To Use In 2023

How Employers Support Employee Wellbeing (What Actually Works)

If you're an employer reading this thinking, "We can't fix people's finances," you're right — and that's not the goal.

The goal is to reduce the pressure points that make financial stress in the workplace worse, and to give employees support that's practical, respectful, and easy to access.

Done properly, this strengthens workplace employee wellbeing without turning HR into a financial advice desk.

1) Financial Education & Guidance (Support Without Overstepping)

A lot of employees aren't looking for handouts — they want clarity, control, and safer options.

Basic financial guidance can reduce stress quickly, especially when it's delivered without judgement or embarrassment.

This matters because when employees don't understand their options, they often turn to high-risk short-term solutions like e-transfer payday loans.

These loans feel fast and convenient, but they usually come with high fees, short repayment windows, and long-term financial consequences that actually increase financial stress in the workplace, not reduce it.

What effective employer support can look like:

- Budgeting tools and resources employees can use privately, such as templates, calculators, and short guides that help them plan around real expenses and avoid emergency borrowing.

- Financial literacy sessions that explain practical topics like debt basics, saving habits, understanding credit, and how payday-style lending (including e-transfer payday loans) can trap people in repeat cycles.

- Access to neutral financial advice through trusted third parties, so employees can explore safer alternatives without feeling like their employer is monitoring their personal finances.

The goal isn't to tell employees what to do with their money.

It's to help them make informed decisions — and to reduce reliance on high-cost, short-term borrowing that quietly undermines employee wellbeing.

This is one of the simplest and most effective ways employers support employee wellbeing while keeping boundaries clear, dignity intact, and financial stress from escalating further.

2) Fair Pay Transparency (Because Uncertainty Creates Stress)

Even when pay is competitive, confusion and secrecy can cause stress.

People start guessing, comparing, and worrying — and that uncertainty is a quiet driver of disengagement.

Strong employers reduce this by:

- Publishing clear pay structures and progression paths

- Having honest conversations about compensation (what's possible now, what's realistic later)

- Removing uncertainty around things like overtime, bonuses, salary reviews, and promotion criteria

Transparency doesn't mean promising raises you can't deliver. It means being straight with people — and that alone lowers anxiety.

3) Flexible Benefits & Real Support (Where It Actually Helps)

This is where many wellbeing programmes fail: they offer benefits employees don't need, while ignoring the ones that solve real-life problems.

More effective options include:

- Salary advance options (structured, fair, and not predatory)

- Emergency assistance programmes for genuine short-term hardship

- Benefits aligned with reality, like childcare support, transport help, healthcare support, or debt-management access

The key here is relevance. If employees can't use it or don't need it, it won't improve wellbeing — it just becomes another unused HR perk.

4) Open Communication Culture (So People Don't Suffer in Silence)

Money stress is still a taboo topic at work.

Most employees won't say anything until things are already bad — and by then you're dealing with burnout, absence, or resignation.

A healthier approach is to:

- Normalise conversations about financial pressure without forcing anyone to share personal details

- Train managers to respond appropriately (listen, signpost support, don't judge)

- Remove stigma by making support feel normal — not like a special case

This isn't about asking employees to disclose their bank balance. It's about building a culture where people can say, "I'm struggling," and be pointed toward support — not punished for it.

So bassically you don't need a huge budget to help.

You need the right kind of support in the right places. When employers address the financial side directly, employee wellbeing improves, culture stabilises, and performance becomes more consistent — because people can finally think clearly again.

Next, we'll cover the warning signs of financial stress in the workplace and how to spot it early before it turns into disengagement, absence, or churn.

The Role of Digital Workplace Tools in Supporting Wellbeing

Supporting workplace employee wellbeing isn't just about introducing new benefits — it's about making support visible, accessible, and easy to use.

This is where digital workplace tools play a critical role, not as monitoring systems, but as enablers of clarity and trust.

A well-designed digital workplace reduces one of the biggest contributors to stress: uncertainty.

When employees don't know where to find information, who to ask, or what support exists, stress compounds — especially for those already dealing with financial pressure.

As Josh Bersin, global HR analyst, puts it:

Wellbeing at work isn't about adding more programmes. It's about removing friction, confusion, and anxiety from the employee experience.

Josh Bersin, global HR analyst

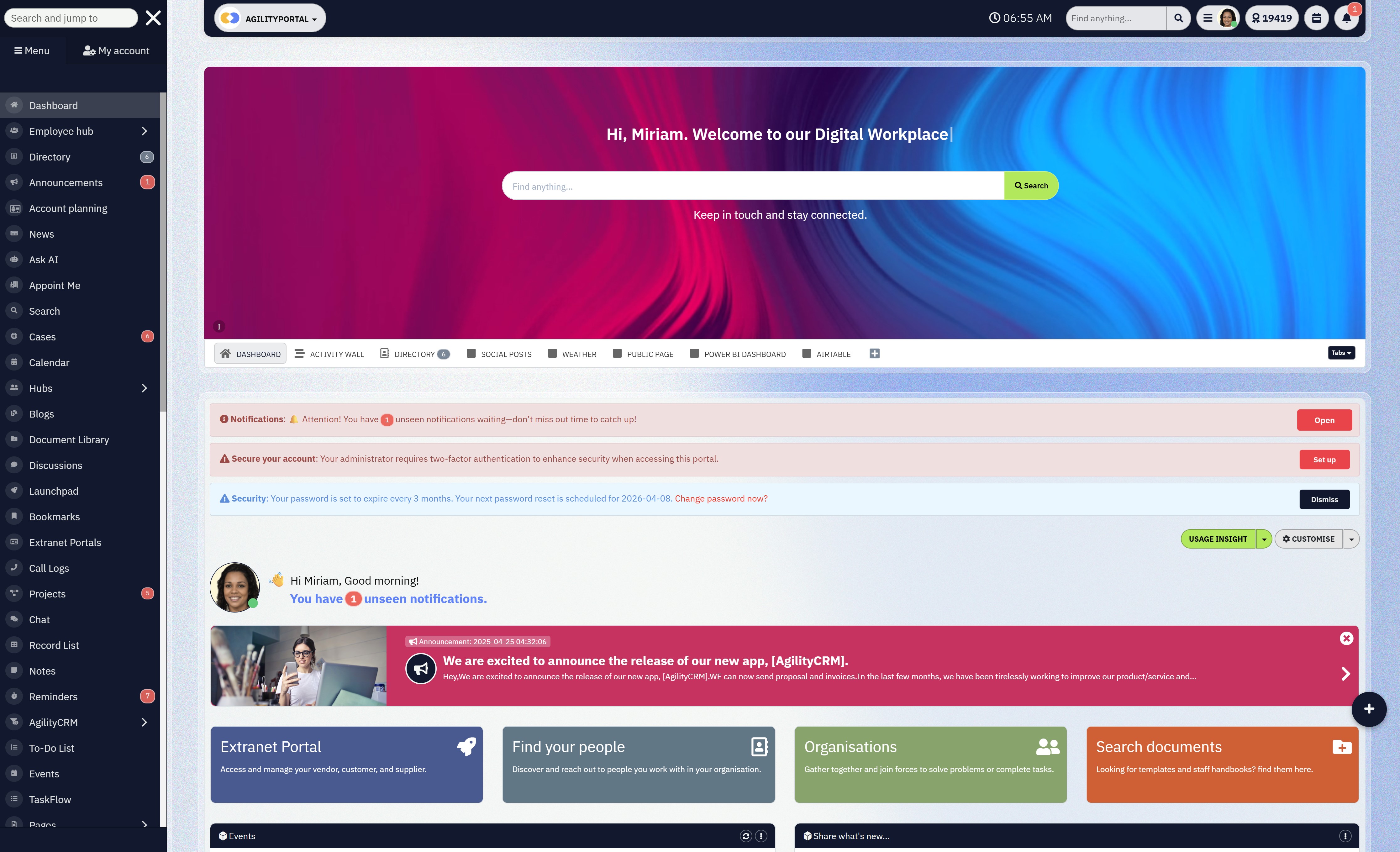

That's exactly where platforms like AgilityPortal add real value.

AgilityPortal works as a single, central hub for communication, knowledge, and employee resources.

Instead of scattering wellbeing information across emails, PDFs, and disconnected tools, everything lives in one place that employees already use as part of their day-to-day work.

How Digital Tools Supports Employee Wellbeing in Practice

Centralised communication

Important updates, policy changes, and wellbeing messages are delivered consistently, reducing confusion and speculation.

Employees don't have to guess or chase information — they know exactly where to look.

This matters because inconsistent communication is a known stress multiplier.

According to Gallup, employees who strongly agree they receive clear communication are significantly less likely to experience burnout.

One place for support resources

Financial wellbeing guides, benefits information, internal support contacts, and external resources can all be accessed from a single location.

This is especially important for sensitive topics like financial stress, where employees may prefer to explore support privately and in their own time.

As Arianna Huffington explains:

People don't avoid support because they don't need it — they avoid it because it's hard to find or uncomfortable to ask for.

Arianna Huffington

Digital tools removes that barrier by making support easy to access without stigma.

Clear policies and benefits visibility

Those tools allows organisations to clearly document and surface policies around pay, benefits, financial support programmes, and wellbeing initiatives.

Clarity alone removes a surprising amount of anxiety.

This aligns with guidance from Chartered Institute of Personnel and Development, which consistently highlights transparency as a key driver of employee trust and wellbeing.

Feedback loops without pressure

Built-in pulse surveys and feedback tools help employers spot early signs of disengagement or stress trends across teams — without tracking individuals or invading privacy.

This makes it possible to respond early, rather than waiting for burnout, absence, or resignations.

Enablement, Not Surveillance

The key distinction is intent.

AgilityPortal isn't about watching employees — it's about supporting them. Data is used to understand patterns, not police behaviour.

Employees stay in control, while leaders gain insight needed to improve communication, support, and wellbeing strategies.

As Laszlo Bock notes:

Laszlo BockThe best people systems don't control behaviour — they create the conditions for people to do their best work.

In short, AgilityPortal helps organisations turn good intentions into practical action.

By reducing friction, improving access to support, and creating clarity, it strengthens employee wellbeing while building trust — which is exactly what's needed when addressing financial stress in the workplace.

Next, we'll look at the warning signs employers should watch for, and how to spot financial stress early before it turns into disengagement or churn.

Warning Signs Employers Should Watch For

Financial stress rarely shows up as someone saying, "I'm struggling with money."

Most of the time, it shows up indirectly — through behaviour, performance, and engagement patterns that are easy to misinterpret if you're not looking for them.

This is why managers and HR teams need to spot the early signals. Acting early is far easier (and cheaper) than reacting after burnout, absence, or resignations take hold.

Here are the most common warning signs to watch for:

You Start to See Sudden Drops in Engagement

Employees who were once proactive and involved may gradually become quieter or disengaged — not because they've stopped caring, but because ongoing financial pressure is draining their mental capacity.

This often shows up as:

- Contributing less during meetings or discussions

- Stopping the flow of ideas or suggestions they previously shared

- Withdrawing from projects or initiatives they were once enthusiastic about

- Doing only what's required, rather than going the extra mile

These behaviours are frequently misread as a motivation or attitude problem.

In reality, they're often signs of financial stress impacting employee wellbeing, where mental overload leaves employees with little energy to engage beyond essential tasks.

Increased Absenteeism

Frequent absences or irregular attendance are often early warning signs of deeper issues.

When financial stress builds up, it affects sleep, mental health, and physical wellbeing — making it genuinely harder for employees to show up consistently, even when they're committed to their role.

This can show up as:

- More frequent short-term sick days rather than long planned leave

- Late starts or early departures becoming more common

- Employees taking time off for vague or recurring health reasons

- Increased use of sick leave around high-pressure periods

- Patterns of absence following poor sleep or burnout episodes

- Employees "pushing through" illness, then needing recovery time

- A noticeable change in attendance compared to their past behaviour

These patterns are often mistaken for reliability issues. In reality, they're frequently signs that financial stress is quietly impacting employee wellbeing, long before someone reaches the point of burnout or resignation.

Lower Participation in Team Activities

Employees experiencing financial strain often start pulling back from optional interactions — not out of disinterest, but as a way to manage stress, energy, or personal circumstances.

This commonly shows up as:

- Skipping optional meetings or team discussions, even when they were previously active

- Avoiding social or team events, especially those that involve time, travel, or spending

- Reducing collaboration, choosing to work in isolation rather than engage with others

On the surface, this can look like disengagement. In reality, it's often a coping response to ongoing financial stress impacting employee wellbeing, where employees are conserving both emotional and financial resources.

Burnout Patterns in Specific Departments

If you notice clusters of burnout, stress, or disengagement within particular teams, roles, or pay bands, it's worth paying attention.

Financial stress often hits unevenly, and patterns across departments are a strong signal that something structural — not individual — is going on.

When these signs are ignored, financial stress quietly escalates. Productivity drops, mistakes increase, and high performers start looking for stability elsewhere.

When they're recognised early, employers have a chance to intervene with support, clarity, and communication — before the situation turns into a retention or wellbeing crisis.

The goal isn't to diagnose personal finances. It's to notice patterns, start better conversations, and put support in place while people are still engaged enough to benefit from it.

Building a Financially Supportive Workplace Culture (Step-by-Step)

This isn't about launching another wellbeing campaign and hoping it sticks.

A financially supportive workplace culture is built deliberately, over time, through clear actions that employees can feel — not just hear about.

Here's how to do it in a way that actually works.

Step 1: Treat Financial Wellbeing as Ongoing Infrastructure (Not a One-Off Initiative)

The biggest mistake organisations make is treating wellbeing like an event: a webinar, a benefits launch, a once-a-year survey.

Financial stress doesn't work that way — it's persistent, so support needs to be as well.

- Make financial wellbeing part of your core wellbeing strategy, not a side project

- Review financial support resources at least annually, not "when there's a problem"

- Ensure new hires are introduced to financial support options during onboarding

If support disappears after launch week, employees assume it was never serious.

Step 2: Align Leadership, HR, and Operations (This Is Where Most Efforts Break)

Culture doesn't change through HR alone.

If leadership says one thing, HR offers another, and managers act differently again, employees disengage fast.

- Get leadership aligned on why financial wellbeing matters to the business, not just employees

- Equip managers with clear guidance on how to respond when someone is struggling

- Ensure HR policies, benefits, and communications are consistent and easy to explain

When leaders, HR, and operations speak the same language, trust increases — and trust reduces stress.

Step 3: Make Support Visible, Simple, and Safe to Use

Support that's hard to find might as well not exist.

Employees under financial stress rarely ask questions — they look quietly.

- Centralise financial wellbeing resources in one clearly signposted place

- Use plain language — avoid legal or HR-heavy wording

- Allow employees to access resources privately, without needing approval or disclosure

If using support feels risky or embarrassing, people won't use it.

Step 4: Measure What Actually Matters (Not Just Perks Usage)

Free tools and benefits don't equal wellbeing.

What matters is whether people feel more secure, informed, and supported.

- Use pulse surveys to track financial stress trends, not individual situations

- Monitor engagement, absenteeism, and turnover alongside wellbeing initiatives

- Ask simple questions like: "Do you know where to find financial support if you needed it?"

Improvement here is a stronger signal than benefit sign-ups alone.

Step 5: Reinforce Through Everyday Behaviour, Not Big Statements

Culture is shaped in everyday interactions — how managers respond, how policies are applied, and how openly challenges are acknowledged.

- Encourage managers to lead with empathy, not assumptions

- Normalise conversations about financial pressure without forcing disclosure

- Acknowledge real-world pressures in leadership communication

Employees don't expect employers to solve everything. They expect honesty, consistency, and support that feels real.

A financially supportive workplace culture isn't built through perks or promises. It's built through alignment, visibility, and consistent action.

When employees feel supported — not judged or ignored — workplace employee wellbeing improves naturally, and so does trust, engagement, and long-term performance.

Why Employers Are Adopting AgilityPortal (and Why Employees Actually Use It)

Most workplaces don't have a tools problem — they have a clarity problem. Information is scattered, communication is noisy, and support resources are hard to find when people actually need them.

That's where AgilityPortal comes in.

AgilityPortal is a modern digital workplace platform that brings communication, knowledge, collaboration, and employee support into one simple hub.

No tool sprawl.

No hunting through emails.

No "where do I find this?" moments.

- Centralises communication so updates, announcements, and conversations land in one place

- Organises documents and knowledge so teams stop duplicating work and guessing

- Surfaces support resources (policies, benefits, wellbeing content) exactly where employees look

- Gives leaders visibility into engagement and adoption — without invading privacy

👉 Start your 14-day free trial or book a quick demo

To see how AgilityPortal simplifies communication, improves engagement, and supports your workforce — without adding another tool to the pile.

To see how AgilityPortal simplifies communication, improves engagement, and supports your workforce — without adding another tool to the pile.

Wrapping up On Supporting Employee Wellbeing Starts With Reality

The connection between financial stress and employee wellbeing is no longer theoretical — it's visible in engagement levels, performance, absence patterns, and retention figures across nearly every industry.

When money worries go unacknowledged, they quietly drain focus, confidence, and trust, no matter how strong a company's values or culture look on paper.

The good news is this: employers don't need to fix anyone's finances.

That's not realistic, and it's not their role.

What is within their control is how well they support people properly — through clarity, communication, practical resources, and a workplace culture that recognises financial pressure as a real part of modern working life.

Support doesn't have to be expensive or intrusive.

Often, it's about removing uncertainty, making help visible, and creating an environment where employees don't feel they have to struggle in silence.

When that foundation is in place, wellbeing initiatives actually land — because they align with reality.

Looking ahead, the workplaces that get this right will stand out.

They'll earn stronger trust, retain talent more effectively, and see more consistent performance — not because employees are "happier," but because they're less distracted, less anxious, and better supported.

In the future of work, employee wellbeing will belong to the organisations willing to face real pressures head-on — not just talk around them.

Global Financial & Wellbeing Resources

Financial stress isn't limited by geography.

While costs and systems differ from country to country, the pressure employees feel — anxiety, uncertainty, and lack of clarity — is universal.

That's why it's important to point employees toward trusted, globally accessible resources they can use privately and at their own pace.

Below are widely recognised resources employers can safely recommend to support employees worldwide.

- OECD – Financial Education https://www.oecd.org/financial/education/

- Khan Academy – Personal Finance https://www.khanacademy.org/college-careers-more/personal-finance

- MoneySmart (Australia – globally usable guides) https://moneysmart.gov.au/

- World Health Organization (Mental Health Resources) https://www.who.int/teams/mental-health-and-substance-use

- Mind (UK) https://www.mind.org.uk/

- Mental Health America https://www.mhanational.org/

- Befrienders Worldwide https://www.befrienders.org/

- Samaritans (International Directory) https://www.opencounseling.com/suicide-hotlines

FAQs: Financial Stress, Wellbeing & Financial Awareness Week (FAW)

How does financial stress affect employee wellbeing at work?

Financial stress in the workplace statistics consistently show links to anxiety, poor sleep, reduced focus, and lower productivity.

When employees worry about money, it impacts mental, emotional, and physical wellbeing — often leading to disengagement, mistakes, and burnout.

Common causes of financial stress in the workplace include rising living costs, debt, insecure income, and lack of financial clarity or support from employers.

What are practical financial wellness tips for employees?

Effective financial wellness tips for employees focus on building confidence and control, not quick fixes.

These include budgeting basics, understanding debt, improving financial literacy, knowing where to access support, and planning for emergencies.

When combined with employer support and clear communication, these steps form the foundation of long-term financial wellbeing.

Is financial wellbeing part of workplace wellbeing?

Yes — financial wellbeing is a core pillar of workplace wellbeing.

A strong financial wellbeing framework recognises that mental health, physical health, and financial security are interconnected.

Employees cannot fully engage at work if they are under constant financial pressure, which is why financial wellbeing is increasingly included in broader wellbeing strategies.

What can employers do to support financially stressed employees?

Employers can support employees by developing a clear financial capability strategy.

This includes access to financial education, transparent pay communication, relevant benefits, signposting trusted financial resources, and creating a culture where financial stress can be acknowledged without stigma.

The goal is support and awareness — not financial control.

Why is Financial Awareness Week (FAW) important for organisations?

Financial Awareness Week provides a structured opportunity for organisations to raise awareness, share resources, and start conversations about money without putting individuals on the spot.

FAW works best when it's part of an ongoing approach, not a one-off campaign, reinforcing long-term financial wellbeing rather than short-term messaging.

How does financial stress affect health and social care workers specifically?

In sectors like health and social care, financial barriers in health and social care are especially common due to shift work, overtime reliance, rising living costs, and emotional labour.

Access to financial resources in health and social care is critical to reducing burnout, absenteeism, and staff turnover in already high-pressure environments.

How can organisations overcome financial barriers in health and social care?

To overcome financial barriers in health and social care, employers should focus on predictable pay structures, clear overtime policies, accessible financial education, and targeted wellbeing support.

Centralised access to resources and open communication are key to reducing financial anxiety in frontline roles.

What role do financial wellbeing advisors play?

The growing demand for financial wellbeing advisor jobs reflects how seriously organisations are taking financial wellbeing.

These roles focus on education, guidance, and strategy — helping employers design support systems that improve financial confidence without crossing into personal financial decision-making.

Categories

Blog

(2757)

Business Management

(339)

Employee Engagement

(214)

Digital Transformation

(186)

Growth

(125)

Intranets

(124)

Remote Work

(61)

Sales

(48)

Collaboration

(44)

Culture

(29)

Project management

(29)

Customer Experience

(26)

Knowledge Management

(22)

Leadership

(20)

Comparisons

(8)

News

(1)

Ready to learn more? 👍

One platform to optimize, manage and track all of your teams. Your new digital workplace is a click away. 🚀

Free for 14 days, no credit card required.