Insight Blog

Agility’s perspectives on transforming the employee's experience throughout remote transformation using connected enterprise tools.

23 minutes reading time

(4571 words)

Still Using Spreadsheets? Automotive CRMs Are Why Modern Dealerships Win — Auto CRMs Explained

Automotive CRMs explained: learn how auto CRMs help dealerships automate follow-ups, improve sales performance, and stop losing leads.

Most car dealerships are still running their sales operation on a messy mix of spreadsheets, inboxes, sticky notes, and half-used software.

It works… until it doesn't. Leads slip through the cracks, follow-ups get missed, and nobody has a clear view of what's actually happening in the pipeline.

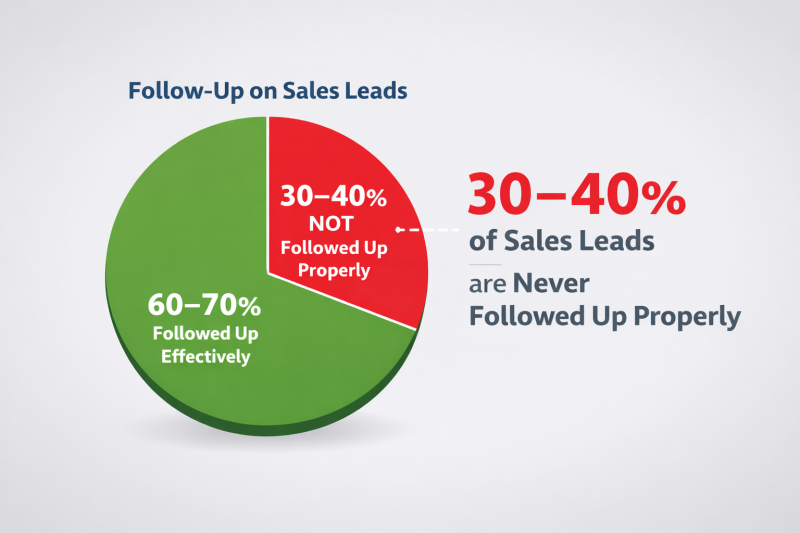

The numbers back this up: studies consistently show that around 30–40% of sales leads are never followed up properly, and response times longer than five minutes can reduce conversion rates by more than 50%.

In an industry where margins are already tight, that's money left on the table.

This setup also kills visibility and customer experience.

When sales data lives in different places, managers can't forecast accurately, sales reps duplicate work, and customers end up repeating the same information over and over.

In fact, research shows sales teams lose nearly 20% of their time just searching for information or updating manual systems instead of selling.

That's not a people problem — it's a systems problem.

This is where automotive CRMs (often called auto CRMs) come in. Not as "yet another tool," but as one connected system designed specifically for how dealerships actually sell vehicles.

Modern auto CRMs centralise leads, automate follow-ups, track every interaction, and give you a real-time view of your sales pipeline — without relying on memory or spreadsheets.

In this guide, we'll break down what automotive CRMs really are, why they matter more than ever, and how to choose the right one without wasting time, money, or patience.

Key Takeaways You’ll Get From This Guide

- 30–40% of sales leads are never followed up properly, costing dealerships real revenue.

- Spreadsheets and legacy tools slow response times and create blind spots in the sales pipeline.

- Automotive CRMs (auto CRMs) centralise leads, automate follow-ups, and prevent missed opportunities.

- Generic CRMs struggle with dealership workflows, while automotive CRMs are built for vehicles, test drives, and repeat buyers.

- Dealerships using modern auto CRMs respond faster, close more deals, and scale without adding admin.

- Integrated automotive CRMs support wider IT services for the automotive industry by connecting data, teams, and processes.

Read this article: : Top 6 AI-Powered Project Management Tools To Use In 2023

What Are Automotive CRMs (Really)?

Let's start with the basics, because a lot of people overcomplicate this.

CRM meaning is simple: it stands for Customer Relationship Management. At its core, a CRM is software that helps businesses track leads, manage customer interactions, and move deals from first contact to closed sale. That's it. No buzzwords needed.

Now, what are automotive CRMs used for?

They do the same job as a regular CRM — but they're built specifically for how car dealerships operate. That difference matters more than most people realise.

Generic CRMs are designed around abstract sales pipelines: stages like "prospect," "qualified," and "closed." Dealerships don't work like that in real life.

Automotive sales involve vehicles, trade-ins, finance, test drives, follow-ups, service history, and repeat buyers. When you force a generic CRM into that workflow, sales teams either fight the system or stop using it altogether.

Automotive CRMs (often called auto CRMs) are designed around the dealership sales cycle from day one.

They focus on:

- Capturing leads from multiple sources (website, walk-ins, phone calls, ads)

- Tracking every customer interaction in one timeline

- Managing follow-ups automatically so nothing gets forgotten

- Linking customers to vehicles, deals, and future opportunities

This is why automotive CRMs sit at the heart of modern automotive dealership software stacks.

They don't replace everything, but they act as the system of record for sales activity. In fact, industry data shows dealerships using a CRM consistently can improve lead response times by up to 60%, and faster response times are directly linked to higher close rates.

The key takeaway is straightforward:

If a CRM isn't designed for vehicles, repeat buyers, and real dealership workflows, it's the wrong tool.

Automotive CRMs aren't about adding complexity — they're about removing friction so sales teams can focus on selling, not chasing admin.

Why Spreadsheets and Legacy Systems Are Holding Dealerships Back

They're fine for static lists, but the moment you try to manage real customers, real follow-ups, and an active sales pipeline, things start breaking fast. Leads get missed, updates fall behind, and nobody trusts the numbers anymore.

This is exactly why IT services for automotive industry are shifting away from manual tools and toward connected, purpose-built systems.

The biggest weakness is manual follow-ups. When leads live in spreadsheets or outdated systems, sales reps depend on memory or reminders that don't fire.

That's why 30–40% of dealership leads are never properly followed up, even though leads contacted within five minutes are up to 9× more likely to convert.

Speed matters — and legacy tools slow everything down.

Another major issue is the lack of a single customer view. Sales, service, and marketing data often live in separate systems, creating silos internally and a frustrating experience externally.

Customers repeat themselves, receive irrelevant follow-ups, and quickly lose trust.

Modern IT services for the automotive industry aim to solve this by unifying data, teams, and customer interactions into one connected workflow — something spreadsheets were never designed to do.

Over time, trust in the data disappears.

Manual updates lead to stale dashboards, managers stop relying on reports, and decisions get made on gut instinct instead of facts.

On top of that, sales teams waste nearly 20% of their working time just searching for information or updating disconnected tools.

This is exactly why the auto business needs specialized CRM. Automotive CRMs (auto CRMs) are built for dealership workflows, not generic sales pipelines.

They centralise leads, automate follow-ups, connect customer interactions across departments, and provide real-time visibility management can actually trust.

Modern IT services for the automotive industry increasingly depend on automotive CRMs as the system that ties everything together.

Main Points at a Glance

- Spreadsheets and legacy tools can't handle real dealership sales workflows

- Manual follow-ups cause lost deals, with 30–40% of leads never contacted properly

- Disconnected systems destroy the single view of the customer

- Sales teams lose around 20% of their time to admin and data hunting

- Automotive CRMs / auto CRMs fix this by automating follow-ups and centralising data

What Modern Auto CRMs Actually Do (Core Capabilities)

Modern automotive CRMs aren't about adding more dashboards or complexity.

Their job is simple: remove friction from the dealership sales process and make sure no opportunity gets lost.

The best auto CRMs focus on a few core capabilities and do them really well.

Lead capture from every channel

Today's buyers don't come from one place.

Leads arrive from your website, paid ads, phone calls, social media, and walk-ins on the forecourt.

A modern auto CRM pulls all of these into one system automatically, so sales teams aren't jumping between tools or manually copying data.

Every lead lands in the same place, tagged with its source, ready for action.

Here's what a good system does:

- Automatic lead distribution among managers by region, vehicle type, or inquiry source

- Prospect scoring based on behavior: viewed prices ten times — hot lead, downloaded one PDF — cold

- Communication sequence setup for different scenarios: new car, used, fleet sales

- Integration with calls and messengers so all communication history stays in one place

Conversion analytics at each funnel stage: how many test drives turn into deals, where customers drop off

Automated follow-ups and reminders

This is where automotive CRMs earn their keep.

Instead of relying on memory or sticky notes, the system schedules follow-ups automatically — calls, emails, or tasks — based on your sales process.

This matters because faster follow-ups directly impact conversions.

Automation ensures no lead goes cold just because someone got busy.

Customer history in one timeline (sales + service)

Strong auto CRMs create a single timeline for each customer.

Every interaction lives in one place: enquiries, test drives, purchases, service visits, and follow-ups.

Sales teams see context instantly, and service teams aren't working blind. Customers don't have to repeat themselves, which immediately improves trust and experience.

Pipeline and deal tracking

Instead of guessing where deals stand, automotive CRMs show the pipeline in real time.

Managers can see how many deals are in progress, which stage they're in, and where bottlenecks are forming.

This visibility makes forecasting more accurate and coaching more effective.

Trade-In and Vehicle Appraisal

Half of new car buyers in the U.S. trade in their old vehicle.

Auto dealership CRM software integrates with appraisal services, stores service history from the dealer network, accounts for wear and market value.

The customer fills out a form online, the system provides a preliminary estimate in seconds, and the manager prepares a final offer before the showroom visit.

Several BMW dealers in Europe are testing AI modules that analyze vehicle photos and automatically detect body damage.

CRM records all defects, compares with average market prices for similar cars, and offers a fair price. Transparency increases, customers argue less, deals close faster.

Financing and Leasing

Modern buyers rarely pay cash. Credit, leasing, vehicle subscription — there are plenty of options. CRM for automotive keeps all these schemes under control:

- Automatic monthly payment calculation depending on down payment and term

- Integration with partner banks for quick application approval

- Financing status tracking: awaiting documents, under review, approved, declined

- Reminders to customers about lease or loan expiration — perfect moment to offer a new vehicle

Volvo Cars launched the Care by Volvo program: fixed monthly payment including insurance, maintenance, and ability to switch cars once a year.

All subscription logic lives in CRM: when the annual period ends, the system reminds the customer about choosing a new model, sends the catalog, arranges a meeting.

Reporting that shows what's working — and what isn't

Good reporting isn't about pretty charts; it's about clarity.

Auto CRMs highlight which lead sources convert, which sales activities drive results, and where deals stall.

This allows dealerships to double down on what works and fix what doesn't, based on data rather than gut instinct.

In short, modern automotive CRMs don't just store data — they actively support how dealerships sell, follow up, and grow.

When these core capabilities work together, sales teams spend less time chasing admin and more time closing deals.

Read this article: : Top 6 AI-Powered Project Management Tools To Use In 2023

How Automotive CRMs Improve Dealership Sales Performance

The biggest sales advantage automotive CRMs bring to a dealership is speed.

When leads are captured automatically and routed to the right salesperson, response times drop dramatically. That matters because faster replies directly translate into higher close rates.

Dealerships that respond within minutes consistently outperform those that respond hours later — not because their teams are better, but because their systems are.

Another major win is smoother handoffs between sales and service.

With auto CRMs, customer information doesn't disappear once a deal is closed.

Sales history, preferences, and previous conversations are visible to service teams, which creates a more joined-up experience for the customer. This continuity builds trust and increases the chances of repeat business and referrals.

Automotive CRMs also dramatically improve data quality. Instead of scattered spreadsheets and partial updates, all sales activity lives in one system.

This creates cleaner, more reliable data that managers can actually use for forecasting. When the numbers are accurate, decisions become clearer — staffing, promotions, and inventory planning stop being guesswork.

There's also a big productivity shift. By automating follow-ups, reminders, and basic admin tasks, auto CRMs free sales teams to focus on what they do best: selling.

Less time updating spreadsheets means more time talking to customers, booking test drives, and closing deals.

This is why top-performing dealerships don't rely on memory or spreadsheets anymore.

They rely on automotive CRMs to create consistency, accountability, and visibility across the entire sales process.

When performance improves, it's rarely because people suddenly work harder — it's because the system finally works with them, not against them.

Automotive CRMs vs Generic CRMs: What Actually Works for Dealerships

At first glance, most CRMs look similar.

They all promise better pipelines, cleaner data, and more control.

The problem is that generic CRMs are built for generic sales teams, not for how dealerships actually sell cars.

That mismatch is where things start to break.

Why generic CRMs struggle in dealerships

- Built around abstract pipeline stages, not vehicles or test drives

- No native understanding of trade-ins, finance, or repeat buyers

- Requires heavy customisation just to match real dealership workflows

- Low adoption because sales teams fight the system

When reps stop using the CRM, data quality drops, visibility disappears, and managers are back to guessing.

This is why automotive CRMs (auto CRMs) exist.

They're designed around dealership reality from day one, which removes friction instead of adding it.

What automotive CRMs do better

- Lead routing based on vehicle, location, or enquiry type

- Single customer timeline combining sales and service history

- Follow-up automation aligned to dealership sales processes

- Real-time visibility into stalled deals and pipeline gaps

There's also an important difference between customisable and built for purpose. Generic CRMs often need months of setup, consultants, and ongoing maintenance.

Automotive CRMs start ready, which means faster rollout and higher adoption.

When a generic CRM might still work

- Very small dealerships with low lead volume

- Simple sales processes with minimal service integration

- Teams already deeply embedded in a specific CRM ecosystem

For most dealerships, though, those conditions don't last long.

At the ednof the day:

Automotive CRMs vs Generic CRMs: Side-by-Side Comparison

| Feature / Capability | Automotive CRMs (Auto CRMs) | Generic CRMs |

| Built for dealership workflows | ✅ Designed specifically for automotive sales cycles | ❌ Built for general sales teams |

| Vehicle & inventory awareness | ✅ Links customers to vehicles, test drives, trade-ins | ❌ No native vehicle context |

| Lead capture sources | ✅ Website, ads, calls, walk-ins in one system | ⚠️ Often requires manual setup or plugins |

| Follow-up automation | ✅ Aligned to dealership sales processes | ⚠️ Generic reminders, not workflow-specific |

| Sales + service customer view | ✅ Single timeline across departments | ❌ Data usually siloed |

| Ease of adoption for sales teams | ✅ High (matches how teams already work) | ❌ Low (forces teams to adapt) |

| Customisation required | ✅ Minimal – built for purpose | ⚠️ Heavy – often needs consultants |

| Reporting & forecasting | ✅ Real-time, dealership-specific insights | ⚠️ Generic reports |

| Time to value | ✅ Fast | ⚠️ Slow |

| Best suited for | ✅ Small to large dealerships | ⚠️ Non-automotive businesses |

Here's How to Choose the Right Auto CRM (No-Regrets Checklist)

Choosing between automotive CRMs isn't about picking the one with the most features.

It's about picking the one your dealership will actually use six months from now.

Most CRM failures don't happen because the software is bad — they happen because it doesn't fit how the dealership really operates.

Here's a simple checklist to keep you out of trouble.

- Fit to your dealership size and sales model - A small independent dealer and a multi-location group don't need the same setup. The right auto CRM should match your lead volume, team size, and whether you sell new, used, or both. If it's built only for enterprise or only for tiny teams, it will either overwhelm you or hold you back.

- Ease of adoption for sales teams - If sales reps hate using it, your data will be useless. Period. Automotive CRMs should feel natural to the way sales teams already work — quick updates, minimal clicks, and no admin-heavy workflows. High adoption matters more than advanced features nobody touches.

- Automation depth (not just dashboards) - Pretty dashboards don't sell cars. The real value comes from automation: lead routing, follow-up reminders, task creation, and alerts when deals stall. If the CRM doesn't actively push work forward, it's just a reporting tool, not a sales system.

- Integration with existing tools - Your CRM shouldn't live in isolation. It needs to connect with your website, lead sources, email, calling tools, and other automotive dealership software you already rely on. The fewer manual handoffs, the cleaner your data and the faster your team moves.

- Reporting that answers real business questions - Good reporting tells you what to do next, not just what happened. Look for reports that show lead response times, conversion rates by source, pipeline health, and salesperson performance. If managers can't act on the data, the reports are pointless.

The best automotive CRM isn't the most complex one — it's the one that fits your dealership, gets used every day, and quietly removes friction from the sales process.

Choose for adoption and automation first, and everything else falls into place.

Common Mistakes Dealerships Make When Adopting Automotive CRMs

Most dealership CRM failures don't happen because automotive CRMs don't work — they happen because of how they're chosen and rolled out. The software usually gets blamed, but the real problems are avoidable.

One of the biggest mistakes is overbuying features nobody uses.

Many dealerships get sold on long feature lists, advanced analytics, and "enterprise" capabilities they don't actually need.

The result is a bloated system that feels complicated, slows teams down, and delivers very little real value. If features aren't used daily by sales teams, they're dead weight.

Another common issue is ignoring onboarding and training.

Dealerships often assume sales reps will "figure it out," which rarely happens. Without proper onboarding, adoption drops fast, data quality suffers, and managers lose trust in the CRM. A short, focused rollout with real training beats a powerful system nobody understands.

Choosing software sales teams hate is another costly mistake. If a CRM feels slow, clunky, or admin-heavy, reps will avoid it. When that happens, activity gets logged late or not at all, and the system becomes unreliable. Automotive CRMs must support how sales teams work — not force them into rigid processes that don't match reality.

Finally, many dealerships make the mistake of treating CRM as "IT software" instead of a revenue system. CRM isn't just a database or reporting tool; it's a sales engine.

When ownership sits only with IT and not with sales leadership, the system loses focus.

The most successful dealerships treat their auto CRM as core revenue infrastructure, not just another tool to maintain.

Automotive CRMs succeed when they're chosen for adoption, rolled out with intent, and owned by the sales team. Avoid these mistakes, and the CRM becomes a growth driver instead of a frustration.

The Future of Automotive CRMs: What's Coming Next (and Why Early Adopters Win)

From an industry point of view, automotive CRMs are no longer just sales tools — they're becoming the central nervous system of the modern dealership.

As buyer behaviour shifts online and margins tighten, dealerships are being forced to operate faster, smarter, and with far less manual effort than before.

The first big shift is more automation, less manual input. Industry data shows sales teams already lose around 20–30% of their time on admin tasks like logging activity, updating records, and chasing follow-ups.

Future-facing auto CRMs are aggressively removing this friction by automating lead capture, follow-ups, task creation, and status updates. The goal is simple: if it can be automated, it should be.

Dealerships that reduce admin don't just save time — they increase selling time, which directly impacts revenue.

The second major trend is better customer experience tracking. Modern buyers expect consistency across every touchpoint. In fact, studies show over 70% of customers expect companies to understand their needs across interactions, yet most dealerships still operate with fragmented data.

Automotive CRMs are evolving to track the full customer journey — from first enquiry to vehicle history, service records, and repeat purchases — all in one timeline. This gives dealerships the context needed to personalise follow-ups and build long-term loyalty, not just close one-off deals.

We're also seeing AI-driven lead prioritisation, but without the hype. Instead of vague "AI insights," practical auto CRMs are using real data signals — response time, enquiry intent, vehicle demand, and past behaviour — to highlight which leads are most likely to convert.

This matters because not all leads are equal, and industry benchmarks consistently show that focusing on high-intent leads first can improve close rates by 10–20% without increasing lead volume.

From an ecosystem perspective, integration is where the real value emerges. Automotive CRMs are increasingly designed to plug into trusted industry tools like carVertical.

By integrating vehicle history and background checks directly into the CRM workflow, dealerships can:

- Instantly enrich customer and vehicle records

- Build trust earlier in the sales conversation

- Reduce deal friction caused by unanswered vehicle historye questions

- Support compliance and transparency expectations

This kind of integration reflects how IT services for the automotive industry are evolving — away from isolated tools and toward connected platforms that share data seamlessly.

Why early adopters will widen the gap is straightforward.

Dealerships that adopt modern automotive CRMs now benefit from faster response times, cleaner data, better customer experiences, and smarter prioritisation.

Late adopters, meanwhile, are still fighting spreadsheets, siloed systems, and manual processes. Over time, that gap compounds — not because early adopters work harder, but because their systems work smarter.

The future of automotive CRMs isn't about flashy features. It's about automation, connected data, and intelligent prioritisation.

Dealerships that embrace this shift early won't just keep up — they'll pull further ahead while others struggle to catch up.

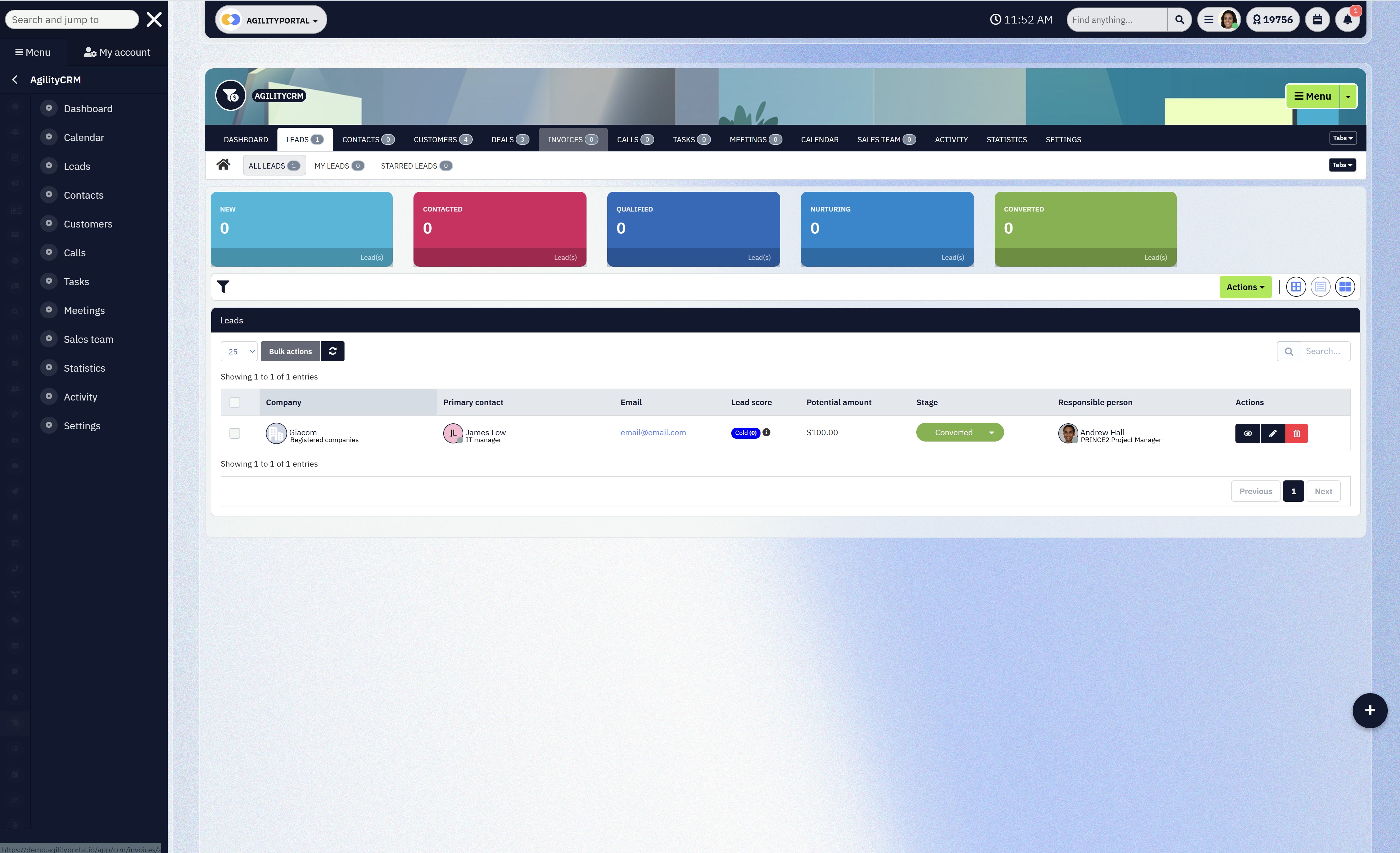

Still Using the Wrong CRM? Meet AgilityCRM — Built for Real Automotive Teams

If you're serious about moving beyond spreadsheets and half-used tools, this is where AgilityCRM comes in.

AgilityCRM is the CRM module inside AgilityPortal, designed to work the way modern automotive teams actually operate — not how generic CRM vendors think you should work.

It's built to centralise leads, automate follow-ups, and give you full visibility across sales activity without adding complexity or admin overhead.

Unlike traditional CRMs, AgilityCRM doesn't live in isolation.

It sits inside a wider digital workplace, meaning your CRM connects naturally with communication, documents, tasks, analytics, and collaboration — all in one platform. No tab-hopping. No disconnected data. No guessing.

Why automotive teams choose AgilityCRM

- Centralise all leads and customer interactions in one place

- Automate follow-ups so no opportunity goes cold

- Track pipelines and performance in real time

- Improve adoption with a clean, easy-to-use interface

- Scale easily as lead volume and teams grow

The result is simple: less admin, faster responses, cleaner data, and more deals closed.

If your dealership is ready to stop managing chaos and start running sales properly, AgilityCRM inside AgilityPortal gives you a practical, scalable way to do it — without ripping everything out and starting again.

👉 Want to see it in action? Book a demo of AgilityPortal and explore how AgilityCRM fits into a smarter, connected automotive workflow.

Wrapping up: Stop Managing Leads — Start Winning Deals

Sticking with spreadsheets and disconnected tools has a real cost.

Leads get missed, follow-ups happen too late, data can't be trusted, and sales teams spend more time managing admin than selling cars.

Over time, that drag shows up in lower close rates, weaker customer experience, and slower growth — even when lead volume is high.

That's why automotive CRMs aren't optional anymore. The industry has moved on.

Buyers expect fast responses, personalised conversations, and consistency across every interaction. Spreadsheets and legacy systems simply can't keep up.

A modern auto CRM gives dealerships one place to manage leads, automate follow-ups, track performance, and see what's really happening in the pipeline — in real time.

The takeaway is simple and proven:

dealerships that win don't work harder, they work smarter. They replace manual chaos with structured systems, rely on data instead of guesswork, and let the right automotive CRM do the heavy lifting.

When the system works, the team performs — and deals get closed.

Frequently Asked Questions (FAQs)

What is a CRM in automotive?

A CRM in automotive is software used to manage leads, customer interactions, follow-ups, and sales activity across a dealership or car garage.

A CRM for car dealerships helps track enquiries, schedule follow-ups, manage test drives, and build long-term customer relationships — all in one system.

What is the best CRM for automotive?

The best CRM for auto dealerships depends on dealership size, sales volume, and workflow complexity.

High-performing dealerships typically choose automotive-specific platforms rather than generic tools.

The best automotive CRMs are built around vehicle sales, repeat buyers, service history, and fast lead response — not generic pipelines.

Who are the main automotive CRM providers?

There are many automotive CRM providers, ranging from dealership-focused platforms to large enterprise systems.

Some dealerships use specialised automotive tools, while others adapt broader platforms like Salesforce Automotive.

The key is choosing a CRM designed for automotive workflows, not just sales in general.

What are the top 5 CRM systems?

The "top 5" CRM systems vary by industry. In automotive, the strongest options are typically:

- Automotive-specific CRM platforms

- CRM modules built into automotive DMS systems

- Customised enterprise platforms like Salesforce Automotive

- Regional solutions such as automotive CRM Canada providers

- Integrated dealership platforms combining CRM and operations

What matters most is fit, adoption, and automation — not brand name alone.

What are the 4 types of CRM?

The four main types of CRM are:

- Operational CRM – manages sales, marketing, and service workflows

- Analytical CRM – focuses on reporting and customer insights

- Collaborative CRM – improves communication across teams

- Strategic CRM – supports long-term customer relationships

Most automotive CRMs combine all four to support dealership operations.

Is there a free automotive CRM?

Yes, there are free automotive CRMs, but they usually come with limits on users, automation, or reporting.

Free tools can work for very small dealerships or car garages, but most growing dealerships outgrow them quickly and move to paid systems for better automation and visibility.

What is the difference between an automotive CRM and an automotive DMS?

An automotive CRM focuses on leads, customers, and sales activity, while an automotive DMS (Dealer Management System) handles inventory, accounting, compliance, and operations.

Many dealerships use both, with the CRM driving sales performance and the DMS managing backend processes.

Can automotive CRMs work for car garages?

Yes.

A car garage CRM helps independent garages manage customer records, service reminders, follow-ups, and repeat business.

While simpler than dealership CRMs, the goal is the same: better organisation, faster responses, and stronger customer relationships.

Do automotive CRMs require training?

Yes — and that's a good thing.

Proper automotive CRMs training is critical for adoption and data quality.

The best systems are easy to learn but still provide onboarding and training so sales teams actually use them consistently.

How does Selly automotive CRM compare to other tools?

Selly automotive CRM is one of several dealership-focused solutions available.

Like any CRM, its effectiveness depends on dealership size, workflow fit, and how well it's adopted by the sales team. Comparing features, automation depth, and reporting is essential before choosing.

Categories

Blog

(2759)

Business Management

(339)

Employee Engagement

(214)

Digital Transformation

(186)

Growth

(125)

Intranets

(124)

Remote Work

(62)

Sales

(48)

Collaboration

(44)

Culture

(29)

Project management

(29)

Customer Experience

(26)

Knowledge Management

(22)

Leadership

(20)

Comparisons

(8)

News

(1)

Ready to learn more? 👍

One platform to optimize, manage and track all of your teams. Your new digital workplace is a click away. 🚀

Free for 14 days, no credit card required.