Insight Blog

Agility’s perspectives on transforming the employee's experience throughout remote transformation using connected enterprise tools.

9 minutes reading time

(1816 words)

How to Train Your Employees to Deal with Online Frauds?

To prevent fraud, thoroughly train your employees, and then follow up to make sure that training is consistently put into practice.

As per recent Microsoft data, online technical support frauds remain a significant issue. Generation Z and Millennials are most prone to fall for these ruses.

According to the same report, tips are used to uncover 43% of cases of fraud, and only 50% of such tips originate from staff members. How is this figure so low when these individuals work for the company, follow procedures, and may even coexist alongside fraud suspects?

Coworkers should be the first to notice abnormalities and anomalies, but how will they learn what to check for?

What if they are unable to detect fraud because they are unaware of the possibility it exists in a procedure?

By boosting fraud literacy and teaching every employee how to spot fraud, there's a huge opportunity to leverage the strength of the workplace as a whole.

8 Ways to train your staff on standard fraudulent practices

Basic knowledge to assist your staff in recognizing when things are off should be part of extensive fraud awareness and training. These fundamental details include who, why, and when people commit fraud.

Take into account pertinent case studies, images that illustrate the tale, and the impact fraud has both on the individual worker and the firm. Include information on how, where, and to whom employees should report concerns.

#1. Incorporate examples

Include instances that are directly related to the worker's job in your description of the types of frauds, which might occur at your business. Instead of warning employees that they could be targets of vendor fraud, explain to them what a supplier scam looks like. Ensure that they are aware of the steps they can take regularly to avoid it.

Educate staff members on the importance of comparing inventory deliveries to shipping documents, bills of lading, or order forms to prevent receiving poor, insufficient, or disagreed-upon merchandise from a supplier. This dialogue enables workers to understand that what they once perceived as routine chores actually serve to safeguard the business and, eventually, their jobs.

The ability to demonstrate how fraud significantly influences the employee during training is among its most effective components. Link the possibility of lost benefits or payment, loss of employment, and business collapse to the fraud. Emphasize the reputational costs associated with fraud, whether they result from the crime itself or the fact that a scam was uncovered.

In this stage, give particular instances of situations that led to an organization's dissolution and the accompanying loss of jobs. Sadly, there are several examples, and stories like Clive Peters, an Australian large box electronics retailer that a single payroll employee toppled, are very powerful.

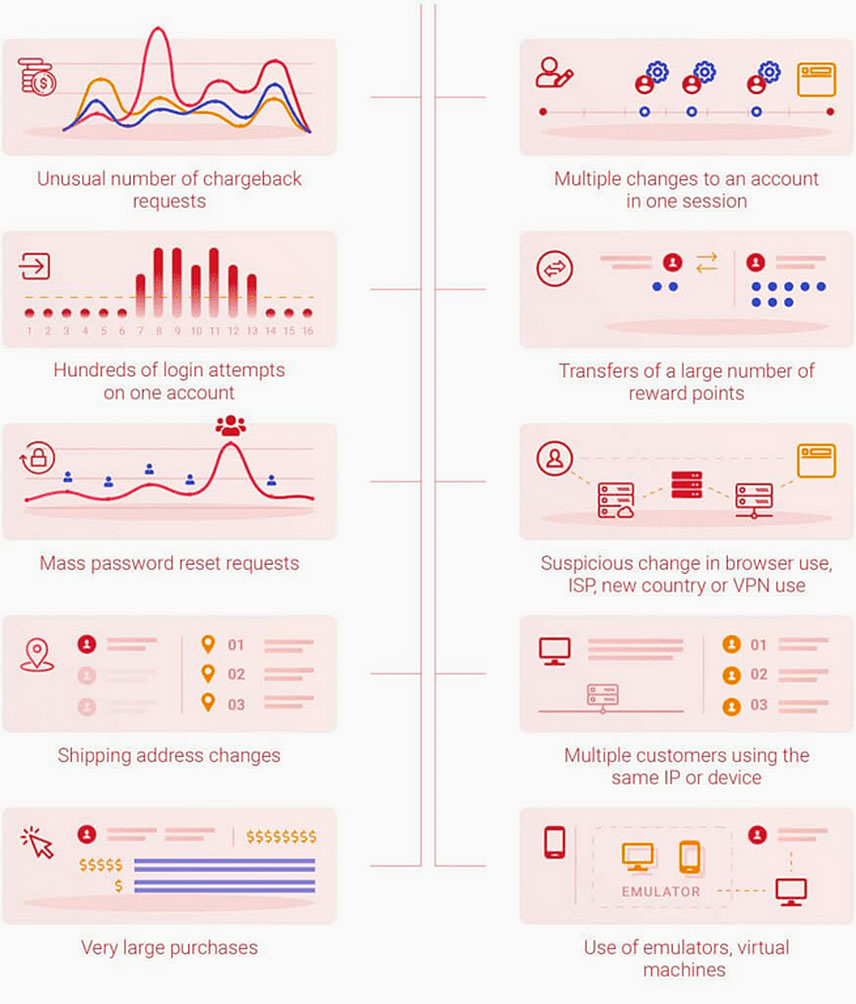

#2.Teach staff what to look out for

Educate your employees on the different types of fraud:

- Creating accounts using stolen identities or private details is known as "new account fraud."

- CNP fraud is described as a fraudulent payment/scam without the consent of the correct card owner. The most common forms and techniques for CNP fraud include online and mobile sales, telephone transactions, skimming, and testing. SEON offers an excellent resource on CNP fraud

- Utilizing credit and debit cards without permission is known as card fraud.

- Check fraud includes using forged checks and checks written without authorization.

- Phishing is defined as the practice of making false requests for personal or business details that could be used to commit identity theft, often requiring victims to undergo identity restoration afterward.

- Identity theft is the unlawful use of another individual's financial or personal information.

- Billing for goods or services that weren't delivered

- Charging for excessive service usage

- Kickbacks

Choosing the procedures and policies you want to implement initially is crucial to giving training that is efficient. For instance, if you own a retail business and want to stop identity fraud, you can decide that personnel must confirm two types of documentation before collecting cheques or credit cards.

When you have a policy like that, teach your staff and make sure they adhere to it regularly. Similar principles apply to the internal control system; if you make a decision that one worker must check the validity of deliveries at the shipping dock and then another individual should verify the authenticity of items received prior to actually putting them in stock, train staff, adequately and then conduct periodic checks to ensure your procedures are being adhered to.

Then, develop clear policies for what personnel are expected to do in the event of internal or external fraud. Your methods for dealing with external fraud might be simple and shouldn't call for a lot of employee judgment. For instance, before continuing, a cashier should alert management right away if they believe a consumer is trying to use a fraudulent credit card.

#3.Stay away from complicated terms

Avoid using too much "fraud language" while describing the how and what. The objective is to aid employees in comprehending various types of scams and to give instances of what each type can entail. It's crucial to speak in a style that employees can relate to in order to engage them and promote involvement.

People link the conceptual definition of deception to the knowledge that "Wow, this could eventuate (or has occurred) at my company" through the use of concrete instances.

#4.Make depictions of fraudulent profiles

Create a description of a typical scammer and use data and other pertinent material to give it life. Gender (regional and global counts), age group, rank in the organization, the worker's field of employment, average dollar loss, and educational levels are examples of useful types of information.

Emphasize the numbers for "never convicted or accused" and "never disciplined or fired" to show that most scammers are not born criminals. Since "they don't seem or behave like a felon," employees admit that they find it hard to believe the individual at the cubicle beside them can possibly conduct fraud.

Give data-supported facts in your instruction to relate to the idea that it actually could be, and frequently is, the individual you least suspect to counter these prejudices.

#5.Include the reasoning behind the fraud

To prepare personnel for the likelihood of scams happening, it is crucial to comprehend why someone would turn to them. Recognizing the action as dishonest is practically impossible without agreeing with the fraudster's justifications.

What makes a typically moral, trustworthy, and diligent individual commit such a mistake? What may induce people to behave differently? Train your employees to understand the responses to these questions so that they can recognize the real reasons behind someone committing a fraudulent crime.

#6.Highlight common frauds impacting your business

Identifying the most prevalent fraud threats affecting your particular business is necessary before developing effective training in your company. Make sure that the material offered, the risk classifications, and the sample instances are pertinent to your organization.

Due to limited training time, it is vital to focus only on the data and case studies that are relevant to your firm's high-risk areas.

For instance, overseas corruption knowledge might make up a lesser amount of training if your business only works domestically. However, a multinational corporation that conducts business in nations with high rates of corruption should highlight fraud concerns and provide concrete instances of illicit activities.

#7.Incorporate case studies

The greatest influence on employees comes from real-world instances and situations. Although cases from outside the company which could be relevant to the organization are useful, presenting genuine situations inside the firm conveys the most impact. Prepare a document where you generalize the specifics of the deception by stating:

- Kind of fraud

- High-level fraud information

- What took place?

- How did it occur?

- Whoever (usually) did it?

- The duration and the estimated or confirmed loss

- The methods used to find the scam

- The result

It is essential to anonymize the examples so that learners may concentrate on hazards rather than specifics that could lead them to infer the perpetrator's identity or the precise location of the occurrence. In a manner that data and statistic models absolutely cannot, internal studies highlight the realities of scams. Throughout the training, it is at this point when you begin to hear murmurs and whispers asking, "Did she really say that transpired here?"

#8.Make your sessions relevant

The secret to boosting employee tips is providing workers with the information and understanding of workplace fraud. Individuals are likely to address fraud if they understand how it appears in their environment and that there is a route to anonymous complaints, which can lower losses.

Giving staff the go-ahead to inquire about the dubious is crucial. The information must be delivered in plain language that is appropriate for their workplace. Your entire organization will nurture awareness and produce fraud fighters if you make your training enjoyable, relevant, and localized.

Implement the following procedures and teach staff to use them following a company-wide review. Included in internal training should be:

- Create distinct tasks with built-in checks and balances. impose a multiple-approval requirement for purchases. Have several people manage the accounting, payroll, transfers, and general ledger balance.

- Employees should receive basic financial training. It is simpler for someone to perpetrate fraud when a financial procedure is handled by just one person.

- Train staff to do fundamental internal audits away from their primary work area. Monitoring is a powerful deterrent.

Then concentrate on educating staff members to spot external fraud sources, such as data breaches. Not only is it a smart move to safeguard your company and your clients, but it's also required by law to establish protocols to protect against identity theft.

Wrapping up

The measures taken in cases of internal fraud might not be as obvious. Create a discreet channel for workers to communicate their worries to foster a trusting environment.

Many workers will be reluctant to charge others for engaging in dishonest or unethical activity.

The whistle-blower or the suspected offender is protected by anonymity; if the allegations are baseless, nobody has to know that there were any doubts, to begin with.

Train your staff properly to avoid fraud, and then monitor their implementation to ensure that the instruction is being used as intended.

Author bio

Atreyee Chowdhury works full-time as a Content Manager with a Fortune 1 retail giant. She is passionate about writing and helped many small and medium-scale businesses achieve their content marketing goals with her carefully crafted and compelling content. She loves to read, travel, and experiment with different cuisines in her free time. You can follow her on LinkedIn.

Categories

Blog

(2660)

Business Management

(325)

Employee Engagement

(213)

Digital Transformation

(178)

Growth

(122)

Intranets

(120)

Remote Work

(61)

Sales

(48)

Collaboration

(39)

Culture

(29)

Project management

(29)

Customer Experience

(26)

Knowledge Management

(21)

Leadership

(20)

Comparisons

(7)

News

(1)

Ready to learn more? 👍

One platform to optimize, manage and track all of your teams. Your new digital workplace is a click away. 🚀

Free for 14 days, no credit card required.