Insight Blog

Agility’s perspectives on transforming the employee's experience throughout remote transformation using connected enterprise tools.

8 minutes reading time

(1559 words)

Compliance Scorecard – Examples, Templates, Metrics & More!

Multiple compliance initiatives currently lead to silos that operate independently of one another, resulting in duplication of work, redundant solutions, greater costs, as well as an elevated level of risk.

More and more companies are focusing on compliance, and they're implementing a variety of strategies to do so. However, there is still no full view of all compliance data available. However, an organization's compliance must be communicated to a variety of parties, both inside and outside the company. It is necessary to create a centralized system for tracking compliance, ideally based on an existing reporting model. For reporting purposes, a balanced scorecard is already generally accepted and used in principle and practice. Follow these steps to quantify the strength of your internal lines of communication.

Complying with legal rules, regulatory standards, or voluntary responsibilities is becoming increasingly difficult and time-consuming as the number, complexity, and importance of compliance requirements grows. Multiple compliance initiatives currently lead to silos that operate independently of one another, resulting in duplication of work, redundant solutions, greater costs, as well as an elevated level of risk. A holistic perspective of a company's risk and compliance landscape can be gained by integrating risk management and compliance. In order to have a successful compliance management strategy, companies must implement a thorough and strategic approach for monitoring and controlling their compliance initiatives. A way out of this impasse is the creation of a centralized repository for integrated reporting.

What is a compliance scorecard?

You may use the Compliance scorecard to audit compliance and highlight risks in your cloud environment in a straightforward, transparent manner Managers, auditors, and security teams can all benefit from using it to spot potential compliance risks and take necessary action with the proper resources to minimize them.

Industry Standards like NIST 800-53, ISO 27001, and other security standards have become increasingly difficult because of fast-paced infrastructure upgrades and a growing desire for flexibility. Compliance scorecard makes it easy to check your cloud infrastructure for compliance and detect potential hazards.

This is especially relevant if you want to become ISO 27001 certified, as the standards set by this framework are high, and you cannot afford to overlook any aspect of your information security management system in order to achieve accreditation. Being meticulous in your preparations will avoid a scenario in which you fall short of the minimum requirements for compliance.

All teams (auditors, operations, security, and management) can use the compliance scorecard to identify potential compliance issues. There is also advice on how to use the relevant resources to alleviate those problems. In addition to summaries and history of non-compliant resources, clients can easily understand where they fall short of these compliance tests thanks to a heat-map style of graphic.

👉 Learn more: Download our ebook: Tracking Change Management

Compliance scorecard examples

Every company must adhere to a set of rules and regulations. Businesses must conform to their industry's specific regulations and legislation in order to maintain their status as legitimate firms. Companies that fail to keep up with the ever-changing regulations risk financial ruin and their good name being tarnished.

Continuous monitoring and evaluation of organizational systems to ensure that they meet security standards, regulatory rules, and other industry needs is what compliance management is all about. Everyone in the company is responsible for ensuring compliance. In order to secure data protection and smooth business processes, all employees should have a strong awareness of how to adhere to compliance rules, regardless of their function.

Industry standards and legal requirements are becoming more stringent. Noncompliance can lead to legal and financial penalties, security breaches, and a negative impact on your company's reputation. Using a compliance scorecard, you can make sure that your company is always up to date on the latest regulations and regulations. Consider some of the most important reasons why your company needs to keep an eye on and handle compliance.

Compliance management systems that work effectively aid in the identification and management of security threats. Additionally, these systems necessitate the deployment of particular security measures to ensure compliance. Risk assessments determine the degree of risk that your organization faces and help you prioritize compliance while also establishing practical safeguards against those risks. Automated systems are also useful for identifying and prioritizing the most critical systems and ensuring that the correct fixes have been applied.

👉 Learn more: Get a demo on our Knowledge Management System

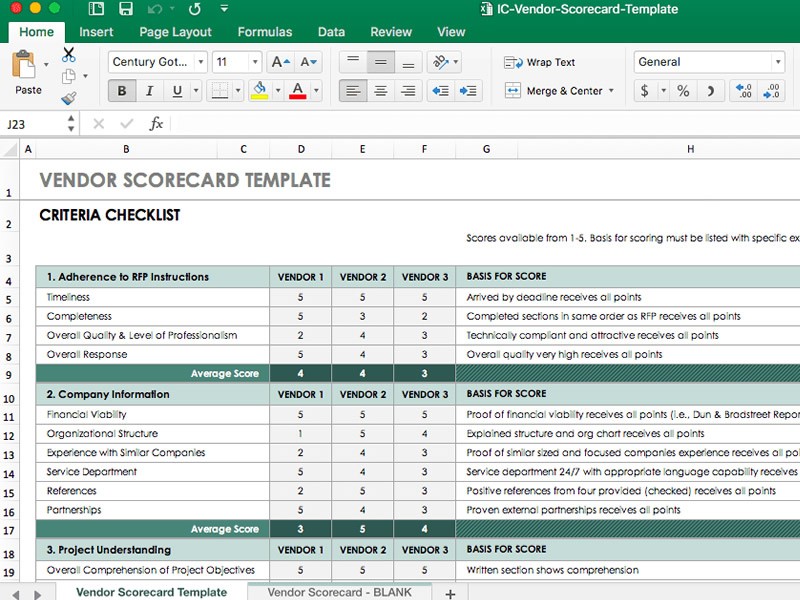

Compliance Scorecard Template

Successful compliance programs require the backing of the board and top management, as well as the modeling of the right behavior by senior executives. The top-end tone is still crucial.

Compliance is more than just the implementation of rules, processes, or internal controls by an individual or a group of people. It's not only a matter of using the correct terminology in conflict of interest or ethical guidelines. Compliance must be facilitated, encouraged, and made easier in an environment that fosters these factors. It's one thing to tell people what the rules, policies, or controls are; it's quite another to instill a sense of compliance and do the right thing even if no one is looking.

The compliance program is an important aspect of developing the correct culture and environment. There are several ways to enforce laws and procedures, including allowing for whistleblowers to come forward, allowing for self-reporting without fear of being retaliated against, and more.

As long as there are no documented norms and processes governing the declared commitment, it's pointless to declare it.

It is not enough to have policies and processes in place if you have a spaghetti-on-the-wall attitude to compliance. The potential or probability of noncompliance and the resulting impact on the organization should be assessed in order to identify compliance risks.

If employees, front-line supervisors, suppliers, and others who are responsible for enforcing or adhering to policies and procedures do not understand their responsibilities, rules, and procedures are of little use. In general, compliance is the responsibility of the company, although individual competence and compliance are equally important. Organizational compliance is in jeopardy if there is no education and awareness program or guidance and support on grey zones and other difficulties.

A company's compliance metrics should be communicated and reported on, regardless of whether it is mandated by law, regulation, or good practice. The board and senior management should be made aware of any successes, failures, achievements, costs, and other metrics. Contract partners, regulators, and others may have a need for external disclosures.

Gathering and analyzing input is the goal of monitoring. It's important to keep track of things like real or suspected non-compliance, the efficiency of your programs, and the cost-benefit ratio. Many firms, for example, have whistleblower hotlines and email addresses that are never checked. Compliance programs must be continually improved to ensure that they are still relevant and effective in protecting against the dangers that an organization faces. You can download the compliance scorecard template from here.

Compliance Scorecard Metrics

Metrics are a set of numerical values that provide useful insight into a certain process. They give you precise data on how the process is working and a foundation on which to make suggestions for changes. Furthermore, if you want to evaluate the process's efficiency, you should use a variety of measures rather than just one.

A company's operational and financial metrics are two distinct sorts of measurements. Operational indicators are closely linked to the success of a company's operations. Typical metrics include turnaround time, number of faults, production time, and so on. There are a number of measures that can be used to identify the fundamental cause of a discrepancy, such as operational metrics. Financial metrics, on the other hand, assess a company's capacity to transfer operational results into financial targets. Comparisons of sales figures and profitability ratios are two examples of this type of measure.

Finally, a compliance program is designed to assist the firm in identifying and mitigating risk. Risk-based program assessments should be tailored to the specific risk profile of each company, according to best practices and regulatory norms. Risk-based evaluation can help you define the metrics you need to identify program improvement.

It's always a good idea to discuss metrics about the dangers your firm faces in order to create support and appreciation from your management team members. Depending on the situation, metrics will be different. Over time, you want to show a decrease in risk. If you can demonstrate that your compliance program has reduced your company's risk profile, you'll get an extra point.

Compliance Metrics Dashboard

Compliance dashboards allow your business to incorporate data from numerous systems used in your organization. In order to build the visual story you want to tell, this data is kept in a central warehouse where it can be easily accessed. This would save you the time and money you currently spend requesting data from various departments, analyzing it, and then creating reports by hand.

Additionally, a dashboard's capacity to filter and integrate data to generate customized reports and to discover patterns in real-time are critical aspects. Your organization's efficiency and inefficiency can be measured using the dashboard. Using the acquired data, the end-user can do drill-downs and data filtering to get the necessary results for tracking metrics, which can then be shared with management or other stakeholders. Your compliance program monitoring efforts are documented in the reports that are created.

Categories

Blog

(2698)

Business Management

(331)

Employee Engagement

(213)

Digital Transformation

(182)

Growth

(122)

Intranets

(120)

Remote Work

(61)

Sales

(48)

Collaboration

(41)

Culture

(29)

Project management

(29)

Customer Experience

(26)

Knowledge Management

(21)

Leadership

(20)

Comparisons

(8)

News

(1)

Ready to learn more? 👍

One platform to optimize, manage and track all of your teams. Your new digital workplace is a click away. 🚀

Free for 14 days, no credit card required.